INSURING A HEALTHY FUTURE

Health insurance is indispensable for mobilising resources, providing risk protection and achieving improved health outcomes

Health insurance is indispensable for mobilising resources, providing risk protection and achieving improved health outcomes

Healthcare financing in India is unique with considerably low share of public financing in total healthcare financing amounting to only about one percent of the GDP, whereas the average share of public financing in other low and middle-income countries is about 2.8 percent. Moreover, a significant portion of the public spending goes into tertiary care, whose beneficiaries are mostly non-poor. There is a need to prioritise public funding for preventive and promotive healthcare, which can benefit the poor. Another striking feature is that the total states’ spending accounts for almost three-fourth of the total public spending on healthcare, which is more regressive than central government’s spending. The World Health Organisation has stated that greater than 80 percent of the total expenditure on health in India is private and most of it is made out-of-pocket directly to private-for-profit healthcare sector. Studies suggest that the rich in India only spend a marginal fraction more than the poor population on healthcare.

Owing to the lack of resources, the poor tend to avoid getting care and on an average, the poorest Indian is 2.6 times more likely to forgo medical treatment, when needed. Further, at least 24 percent of people hospitalised in India fall below the poverty line because of the increased out-of-pocket expenditure towards hospitalisation. As per an analysis, more than 40 percent of people hospitalised, especially those in the bottom four-income quintiles, borrow money or sell assets to pay for the hospitalisation cost. In such a scenario coupled with shrinking public health budgets, increasing healthcare costs and growing demand for health services, health insurance has emerged as the only viable option to save the massive out-of-pocket expenses on healthcare in India and make healthcare affordable and accessible for all.

Health insurance was introduced in India in 1912, when the first insurance act was passed and witnessed little change until 1972, when the insurance industry was nationalised and 107 insurance companies were brought under the umbrella of the General Insurance Corporation (GIC). Further, in 1999 the enactment of Insurance Regulatory Development Act (IRDA) took place, which allowed private and foreign entrepreneurs to enter the insurance market in the country. The bill also facilitated establishment of an authority to protect interest of the insurance holders by regulating, promoting and ensuring orderly growth of the insurance industry. According to the bill, foreign promoters are expected to hold paid up capital of up to 26 percent in an Indian company and requires them to have a capital of INR 100 crore along with a business plan to begin operations.

Health Insurance Market

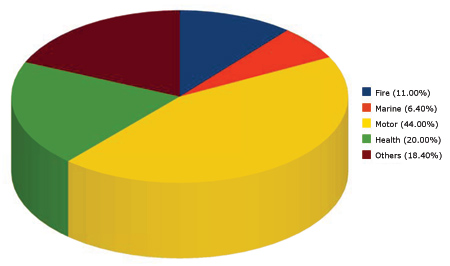

Since 1999, health insurance has been a minor portion of the health ecosystem as currently only about 3 – 5 percent of Indians have their health insured. Further, the market size of commercial health insurance is as low as 1 percent of the total health spending in the country. According to the Annual Report 2008-09 of IRDA, the premium collected for health insurance in India increased from INR 4894 crore in 2007-08 to INR 6088 crore in 2008-08.

In percentage terms, of the total premium collected in the non-life insurance segment, the increase was of about 2.5 percent. IRDA estimated that the overall growth of the health segment has been greater than the general average industry growth.

Insurance for All

A plethora of health insurance schemes currently exist in the country. On a broader scale, these schemes may be segmented as Voluntary Health Insurance Scheme or Private-for-Profit Scheme; Employer-based Schemes; Insurance Offered by NGOs/Community-based Health Insurance Schemes and Mandatory Health Insurance Schemes or Government-run Schemes.

Voluntary health insurance schemes: Voluntary health insurance schemes in India are offered by public as well as private sector companies. In the public sector, the GIC, as well as its subsidiary companies-National Insurance Corporation, New India Assurance Company, Oriental Insurance Company and United Insurance Company; and the Life Insurance Corporation (LIC) of India offer voluntary insurance schemes.

|

IRDA’s Initiatives in the Health Insurance Space |

|

IRDA has been constantly working towards boosting the confidence of policy holders in the health insurance system. In this regard, it has issued two landmark circulars to general insurance companies on- renewability of health insurance policies and health insurance for senior citizens. The renewability of health insurance policy circular, issued on March 31st 2009, protects non-life insurers from declining renewals, unless certain specified reasons and certainly not on the grounds of an insured having made a claim on his policy in the previous year. Also, the circular promotes transparency and advises the disclosure of renewal terms, thereby enhancing fair treatment of policyholders. The circular on health insurance for senior citizens states that health insurance products filed on or after July 1st 2009, must allow entry up to 65 years of age and also to give proper information about the product on the website. The circular suggests clear disclosure of premium amounts to senior citizens and not deny them coverage on baseless grounds. A change of TPA during renewal is also allowed. Through this circular the industry has been encourages the industry to share data on fraudulent entities. |

Employer-based schemes: Employer-based health insurance schemes are offered both by the public as well as private employers. These schemes are usually offered through employer-managed facilities, such as lump sum payments, reimbursement of employees’ health expenditure, fixed medical allowance along with the annual income, monthly or annual allowance irrespective of the actual expenses, or covering all employees under a group health insurance policy. Public sector employers such as Railways and Armed Forces and several private sector employers provide health insurance to their employees. Employer-based health insurance schemes in India, cover only about 30- 40 million people. Out of these, it is estimated that almost 20 million people are covered under reimbursement of health expenditures types schemes.

Community-based schemes: The emergence of community health insurance in the recent years has aimed at improving access to healthcare among the poor and protecting them from indebtedness resulting due to medical expenditure. According to the WHO Report 2000, prepayment schemes are the most effective way to protect people from the unexpected expenditures on healthcare and initiatives need to be taken in this direction in order to cover the poor population under such schemes. The not-for-profit nature of the community-based health insurance schemes makes it one of the viable options for providing healthcare to the poor. Out of about 22 community-based health insurance schemes, initiated in India by various NGOs, almost 10 are active right now.

According to Devadasan et al. 2004, community-based health insurance in India is of three types-type I, type II and type III, depending upon the insurer. In type I (HMO design), the hospital provides healthcare, as well as runs health insurance programmes.

|

Health Insurance – A necessity and not a tax saving instrument Karan Chopra Head – Retail Business HDFC ERGO General Health Insurance Company Limited India is a developing country with over 26% of the population still living below the poverty line. Almost 35% of the population is illiterate. The living conditions in semi urban and rural India, makes the population living there vulnerable to various diseases. Nearly one million Indians die every year due to inadequate healthcare facilities and 700 million people have no access to specialist care and almost 75-80% of medical specialists live in metros and urban cities. Most of the people in India refrain themselves from better medical facilities offered by private players due to the exorbitant expenses. Some avoid medication in totality due to expenses. There is very little awareness about medical insurance in India. The awareness is restricted to urban regions. Insurance is limited to only 10% of the total population. Health insurance coverage among urban, middle- and upper-class Indians, however, is significantly higher and stands at approximately 50%. It is important to understand that health insurance is the means to increase the accessibility to quality healthcare especially to private healthcare providers wherein high cost remains a barrier. Health insurance is fast becoming a necessity considering the effects on health of an individual due to rising pollution levels, change of lifestyle and limited sanitation awareness. It is important that one understands the medical insurance and insures his family against the possible medical expense in the future. |

The type II (insurer design) schemes are run by voluntary organisations, while purchasing care from independent providers. In type III (intermediate design) schemes, the voluntary organisations purchase care from providers and insurance from insurance companies.

Mandatory or Government-run Schemes: Mandatory, government-run health insurance schemes or social health insurance schemes have not yet reached a maturity stage in India. Challenges such as large rural and informal sector, lack of cohesion and solidarity and poor institutional capacity restrict the growth and emergence of social health insurance schemes in India. In these schemes, the premiums are usually based on the person’s income rather than the health risk. These schemes are largely restricted to the employed population in the urban areas. The existing mandatory health insurance schemes in India include Employees’ State Insurance Scheme (ESIS) and Central Government Health Scheme (CGHS).

|

Public Sector’s Voluntary Health Insurance Scheme |

|

| Life Insurance Corporation of India

|

General Insurance Corporation

|

Success Stories

Rashtriya Swasthya Bima Yojana (RSBY): The Government of India decided to launch a health insurance scheme, for the poor, based on a world-class model, that has no pitfalls. The result was the inception of RSBY, a Government funded health insurance scheme for the below poverty line (BPL) population of the country. Launched on 1st April 2008, the scheme requires provides a hospitalisation cover of Rs. 30,000 to a BPL family of five on payment of just Rs. 30 as registration fees by the family. The insurance premium is paid by the Government and ranges somewhere between Rs. 450 and Rs. 650. Being a government funded scheme, the Central Government provides 75 percent of the total funding, while the remaining 25 percent is provided by the respective state governments. Moreover, the scheme has more than 5000 empanelled hospitals, which before empanellment agree to a pre-set cost structure for almost 727 surgical ailments that the beneficiaries are eligible for.

|

Some Community Health Insurance Schemes in India |

||||

|

Scheme |

Location |

Target Population |

Premium Collected |

Benefit Package |

|

ACCORD |

Gudalur, Nilgiris, Tamil Nadu |

Tribals living in Gudalur and members of the AMS union |

Rs. 25 per person per |

Hospitalisation cover up to Rs. 1500 per person per year |

|

BAIF |

Uruli Kanchan, Pune, Maharashtra |

Women (between 18 and 58 years) of the microsavings scheme in 22 villages |

Rs. 105 per person per |

Hospitalisation cover up to Rs. 5000 per person per year |

|

BUCCS |

Buldhana Maharashtra |

Members of the Buldhana Urban Cooperative and Credit Society |

Hospitalisation cover up to Rs. 5000 per person per year |

|

|

DHAN Foundation |

Kadamalai Taluk, Theni District, Tamil Nadu |

Women members of microfinance scheme and living in Mayiladumparai block |

Rs. 100 per person peryear |

Hospitalisation cover of up to Rs. 10,000 per person per year |

|

Karuna Trust |

Nasirpur Block, Mysore District, Karnataka |

BPL families in T Narsipur block |

Rs. 30 per person per |

Hospitalisation cover up to Rs. 2500 per person per year. Includes ambulance services and loss of wages |

|

MGIMS Hospital |

Wardha, Maharashtra |

Small farmers and landless labourers living in 40 villages around Kasturba Hospital |

populationRs. 48 per family of |

Hospitalisation cover up to Rs. 1500 per person per year |

|

Raigarh Ambikapur Health Association |

Raigarh, Chhattisgarh |

Poor people living in the catchment area of the 92 rural health centres and hostel students |

Rs. 20 per person |

Primary and secondary healthcare |

|

SEWA |

Ahmedabad, Gujarat |

SEWA Union women members (urban and rural) and their husbands living in 11 districts of Gujarat |

Rs. 22.50 per person; |

Hospitalisation cover up to Rs. 2000 per person |

|

SHADE |

Kolencherry, Kerala |

Members of the SHGs operating in Ernakulum district |

The Universal Health |

Hospitalisation cover for a family up to Rs. 30,000 per family per year |

|

Student’s Health Home |

Kolkata, West Bengal |

Full-time student in West Bengal state, from Class V to university level> |

Rs. 4 per student per |

Primary and secondary healthcare |

|

Voluntary Health Services |

Chennai, Tamil Nadu |

Total population of the catchment area of 14 |

Rs. 250 per family |

Hospital cover |

|

Yeshasvini |

Bangalore, Karnataka |

Members of the District Farmers’ Cooperative Societies and their families |

Rs. 120 per person |

Cover for all surgeries up to Rs. 100,000 |

|

Key Features of ESIS and CGHS |

||

|

Indicators |

ESIS |

CGHS |

|

Beneficiaries |

Factory sector employees and dependants with income less than Rs. 7500 per month |

Employees and dependants of Central Government; certain autonomous and semi-government organisations; Members of Parliament; judges; freedom fighters; journalists |

|

Benefits |

Medical and other health-related services provided through ESIS facilities and partnerships |

Medical care through public facilities; restricted private care |

|

Premiums |

4.75 percent of employees’ wages; 1.75 percent of their wages by employees; 12.5 percent of total expenses by the state governments |

Varies from Rs. 15 to Rs. 150 per month based on salary of the employee; funded mainly by the Central Government fund |

|

Provider Payments |

Salaries for physicians; hospitals have global budget financed by ESIC through state governments |

Salaries for doctors; treatment in private hospitals reimbursed on case basis |

|

Administrative Costs |

About 21 percent of revenue expenditure. Wages of corporation employees and cash benefits, revenue recovery and implementation in new areas. |

Direct administrative costs; RRT 5 percent of the total expenditure; part of salaries can also be charged to administrative costs |

|

Status of Finances |

More than 80 percent of the ESIS income-double the expenditure on benefits |

About 15 percent of the CGHS income-half of the salary expenditures |

Ever since its inception, almost 17 million smart cards have been rolled out under the scheme covering a BPL population of approximately 70 million people. This just reflects on the tremendous success of the scheme and quickly its expanding to all corners of the country. Various countries such as Pakistan, Bangladesh and several Africa countries are now adopting this scheme based on its success in India.

Rajiv Aarogyasri Health Insurance Scheme: Launched on 1st April 2007 in the state of Andhra Pradesh, the Rajiv Aarogyasri Health Insurance Scheme, demonstrates a unique public private partnership model for offering a health insurance scheme that is tailor made to the health needs of the poor patients. The scheme provides end-to-end cashless services for identified diseases through a network of service providers both in the government as well as the private sector. The scheme is designed, in particular, to address benefit in primary care through screening and outpatient consultations in health camps or network hospitals.

The scheme initially covered 163 identified diseases in 6 systems and gradually extended to 330 diseases in 13 systems under Aarogyasri-I. The coverage extended to 942 procedures in 31 systems and an additional 612 procedures through Aarogyasri-II.

The scheme has been a huge success in the state of Andhra Pradesh, so much so that it is being considered to make it a centrally-assisted scheme. The Government is able to provide insurance coverage of up to Rs 2 lakhs per year on a family floater basis for 2.03 crore families at a cost of only Rs. 400 per family per year. Further the huge disease and patient load ise substantially managed with the implementation model. Every day, at least 8000 patients are screened in health camps and PHC’s, around 4000 patients get registered in network hospitals, around 2500 patients are treated as outpatients and 1500 patients get inpatient treatment. The scheme is also bringing in quality medical infrastructure and expertise to the state. Several new hospitals have come up at the district and sub district levels. Presently on any given day a minimum of 13000 beds are occupied by Aarogyasri beneficiaries across the state. Hence the scheme has stabilised over a period of two years and is financially viable and administratively feasible.

Chief Minister Kalaignar Insurance Scheme for Life Saving Treatments:

The Government of Tamil Nadu launched the Chief Minister Kalaignar Insurance Scheme for Life Saving treatments on 23rd July, 2009 for providing quality and free healthcare for the economically weaker sections and the downtrodden. The scheme has carefully designed the eligibility and benefit criteria to benefit the most needy and deserving. It covers more than 600 surgical procedures that have been identified by senior medical/surgical consultants. The scheme is another example of the successful use of IT applications to deliver efficient services. Use of biometric cards makes the scheme completely cashless and a web-based claims management system has ut the state-wise management of the scheme under a single umbrella, facilitating centralised administration and uniform claim processing across the territory, without any delay. Beneficiaries of this scheme include families of the 27 welfare boards as well as families earning less than Rs.72,000/- per annum. With the currently fixed eligibility criteria, more than 1.3 crore families will get to benefit from this philanthropic project.

|

Health Insurance – A necessity and not a tax saving instrument

Payers throughout the world share the same primary concern- how to survive and stay competitive while healthcare costs are on the rise. In the past few years, many companies approached this challenge by trying to roll out premium rate increases to their customers. This strategy is being met with resistance from employers and retail consumers. With a growing backlog of claims and continually rising costs for administrative processes and medical care, the market is ripe for IT solutions that reduce a company’s operating costs. But the healthcare insurance industry lags behind and has been slow in adopting technology improvements as compared to peers like banking industry. For those considering adopting technology solutions, the decisions range from automating the claims processing and adjudication systems, predictive analytics, membership, billing and customer service processes. Key Success Technical Functionality In addition, Internet functionality of a business process and its related data facilitates a payer’s ability to increase customer satisfaction by providing Web access to health care providers to submit pre approvals and claims electronically. Initiatives by government of India like legalising digital signatures for use in e-comme |

uld_count:

Cookie not set

Value 1: 0

Value 2: 10

P Rammohan

P Rammohan